Towards understanding governance tokens in liquidity mining: a case study of decentralized exchanges

Abstract

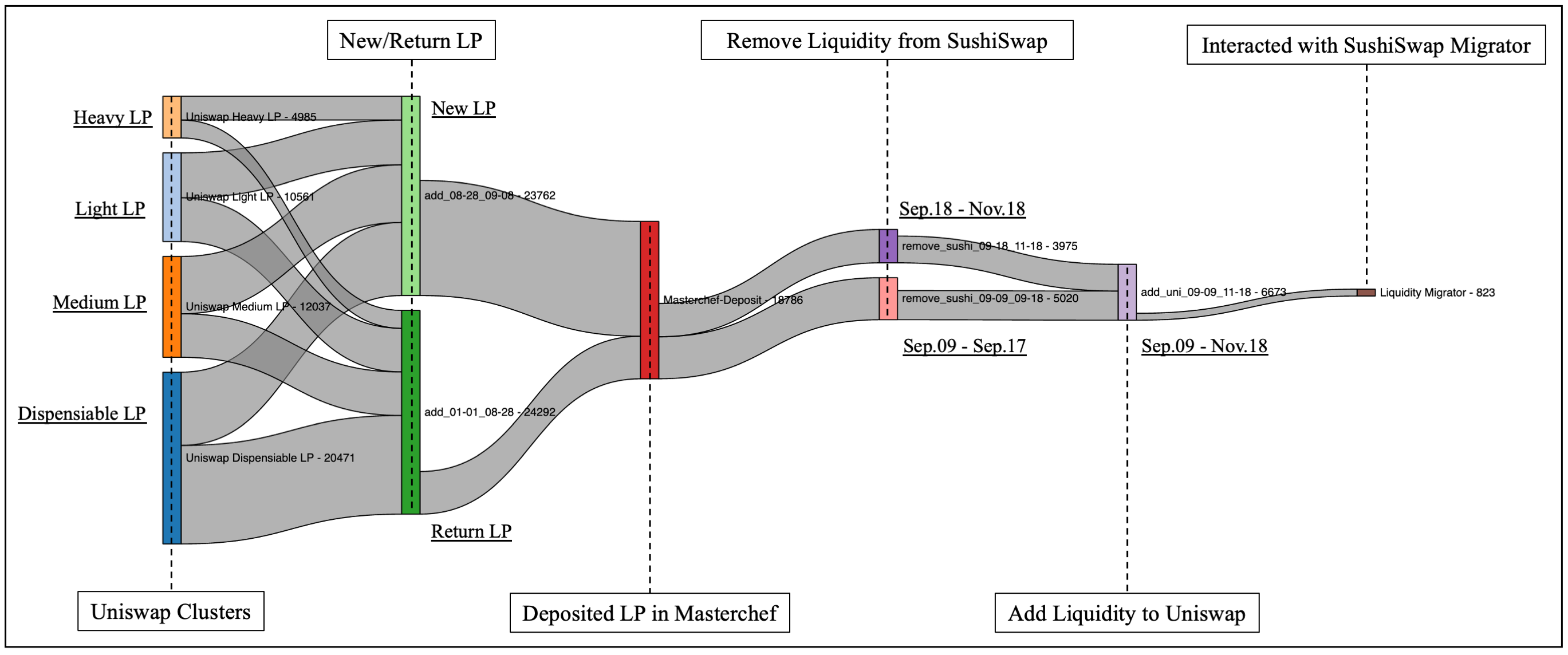

The boom of liquidity mining has attracted enormous attention, which has brought tens of times increment in total value locked (TVL) to decentralized finance (DeFi) community. Meanwhile, governance tokens, as part of the liquidity mining reward, have been adopted by most decentralized applications (DApps) to attract users. However, the effectiveness of this method has not been proven in detail. In this paper, we choose one of the most representative cases where SushiSwap absorbed a significant amount of Uniswap liquidity in no time by forking Uniswap’s code and issuing the governance token ahead to understand the governance tokens in liquidity mining. Specifically, we collect transaction records of Uniswap and SushiSwap for over a year and perform a detailed analysis of liquidity providers’ (LPs) activities. Moreover, we design a scalable unsupervised clustering method, which uses metrics between transaction flows to build a similarity graph that can capture patterns between LPs with similar behaviour. These LPs range from inactive and cautious LPs, providing tiny liquidity to risk-seeking LPs, focusing on short time-intervals. On this basis, we discuss how the governance token affects liquidity mining, and use its impact on behaviours and decision-making to explain its attractiveness to users.